If you are looking for Insurance That Covers FTM Top Surgery, you are in the right place. We have discussed all the important factors about Insurance That Covers FTM Top Surgery.

You might want to reconsider if you think you have insurance covering FTM. That’s because many insurance policies that cover” FTM” usually cover unrelated conditions.

Some insurance companies may even deny coverage for “FTM” because of a preexisting condition. Therefore, it is important to understand your insurance policy fully before signing.

Why Is Top Surgery Important For FTMs?

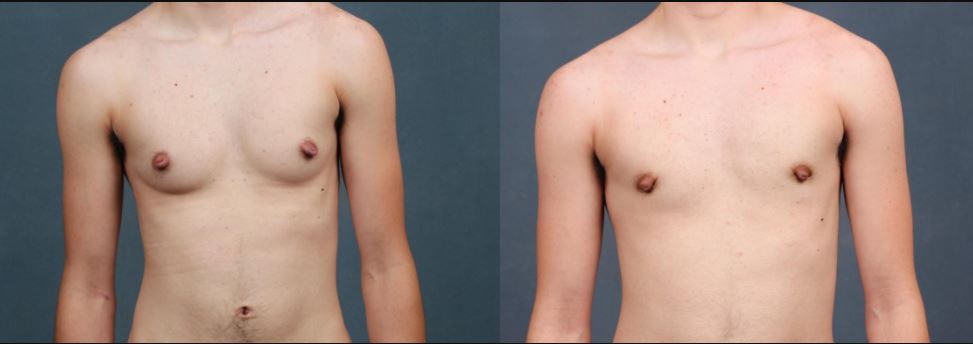

Top surgery is an important step for many female-to-male (FTM) transgender individuals. Also known as masculinizing chest surgery, this procedure involves the removal of breast tissue and creating a masculine chest contour. Top surgery can profoundly impact an individual’s quality of life, helping them feel more comfortable in their skin and express their true gender identity.

Several techniques can be used for top surgery, and the ideal approach for each patient will depend on factors such as anatomy and desired results. Many patients elect to have nipple/areola grafting as part of their surgery, which involves repositioning the nipples and areolas to a more masculine position on the chest. Therefore, it is most important for patients to seek a board-certified plastic surgeon who is experienced in top surgery techniques and nipple areola grafting.

Types Of Top Surgery

Two main types of top surgery for FTMs are double incision and keyhole.

Double Incision Top Surgery:

The double incision is one of the most common types of top surgery. This surgery involves making two incisions on each side of the chest and removing the breast tissue.

The double incision is often used for people who have very large breasts or who have very little breast tissue.

This surgery can also be used to remove excess skin and to make the chest look more masculine.

The double incision is usually done under general anesthesia and takes about two hours to complete. Recovery from this surgery can take up to six weeks.

Keyhole Surgery:

Keyhole surgery is a less invasive type of top surgery that involves making small incisions around the areola, through which the breast tissue is removed.

This type of surgery can be performed as either a single procedure or in combination with other surgeries, such as a breast lift.

Keyhole surgery has a shorter recovery time and less scarring than mastectomy, but it may not be suitable for all patients.

Both types of surgery can be done with or without nipple grafts.

Nipple grafts involve taking skin and tissue from another part of the body to create new nipples.

The type of top surgery you have will be determined by your surgeon based on several factors, including your chest size and shape, the amount of breast tissue you have, and your personal preferences.

Some surgeons may only perform one type of surgery, so it’s important to do your research to find a surgeon who performs the kind of surgery you want.

Cost Of Top Surgery

The average cost of top surgery ranges from $3,000 to $10,000. The actual cost will depend on several factors, such as the surgeon’s experience, the location of the surgery, and the type of procedure being performed. In general, however, patients can expect to pay somewhere in the middle of that range for their top surgery.

Top surgery is a life-changing procedure for many transgender and gender non-conforming individuals. For many people, it is an essential step in their transition.

The surgery itself is relatively simple, but it can be expensive. The good news is that there are several ways to finance top surgery, and many surgeons offer payment plans to make the procedure more affordable.

Insurance That Covers FTM Top Surgery

Most insurance companies in the United States do not cover FTM top surgery, but there are a few that will. The following list of insurance companies that cover top surgery:

- Anthem BC (Anthem Blue Cross).

- Harvard Pilgrim.

- United Healthcare (UHC).

- medicare.

- Cigna.

- Empire Blue Cross Blue Shield of New York State (Excelsior Plan).

- Health Net of New York State (Capital District Physicians’ Health Plan).

- Aetna.

- Blue Cross Blue Shield of Illinois (Healthlink).

- Empire Blue Cross Blue Shield of New York State (Empire Plan).

- BCBS of Texas (NewChoice HMO).

- Health Net of California (Health Net).

- BCBS of Florida (BCBS Sunshine).

- BCBS of Michigan (Blue Care Network).

- BCBS of California (Health Net).

- Blue Cross Blue Shield of Rhode Island (Blue Cross and Blue Shield of RI, HealthSource RI).

- BCBS of Massachusetts (Blue Cross Blue Shield of Massachusetts).

- BCBS of Illinois (Health Alliance Medical Plans, Inc.).

- United Health Care of New York State (Capital District Physicians’ Health Plan).

- Cigna.

How To Get Insurance To Cover Top Surgery?

There are a few things that you can do to get insurance to cover top surgery. The first step is to find a doctor or surgeon willing to work with you and your insurance company. Once you have found a doctor, you will need to get a letter of recommendation detailing why they believe top surgery is medically necessary for you.

The next step is contacting your insurance company and filing a claim. You will likely need to provide them with the letter of recommendation from your doctor and any other medical documentation they require.

It is important to be persistent in following up with your insurance company, as they may take some time to process your claim.

If your insurance company denies your claim, options are still available. You may be eligible to file an appeal with the insurance company and may also be able to take your claim to the Department of Health and Human Services.

If your insurance company denies your claim, options are still available. You may be eligible to file an appeal with the insurance company and may also be able to take your claim to the Department of Health and Human Services.

Method 2: Contact your state Medicaid agency

If you are a Medicaid beneficiary, you can also apply for assistance from HIHN. However, your state’s Medicaid agency must be willing to work with HIHN for this to occur. You should contact your state Medicaid agency to determine if a current agreement exists. If you are a Medicaid beneficiary, you can also apply for assistance from HIHN.

However, your state s Medicaid agency must be willing to work with HIHN for this to occur. You should contact your state Medicaid agency to determine if a current agreement exists.

How Can I Find Out About Insurance Policies That Cover “FTM”?

If you’re considering a transition from male to female, one of the first things you’ll need to do is research your insurance options. Many insurance policies now cover “FtM” or “Female to Male” transitions, but it’s important to check with your provider to see what exactly is covered. Your insurance may cover common procedures and treatments, including hormone therapy, surgery, mental health care, and voice training.

However, here are a few tips on how you can find out about insurance policies that cover “FtM” individuals:

- Check with local support groups or organizations that work with the “FtM” community. They may have information on insurance companies’ coverage for “FtM” individuals.

- Contact your state’s department of insurance. They may have information on local health insurance coverage for “FtM” individuals.

- Check with an agent from your insurance company. They may have information on local health insurance coverage for “FtM” individuals.

- Check with a local medical provider who has experience working with transgender patients. They may have information on local health insurance coverage for “FtM” individuals.

- Contact a local transgender support group or organization. They may be able to assist you in finding health insurance plan providers that cover “FtM” individuals.

- Contact an LGBT legal organization. They may be able to assist you in finding health insurance plan providers that cover “FtM” individuals.

Conclusion

Regarding insurance coverage for FTM top surgery, there are a few things to keep in mind. First and foremost, not all insurance companies are created equal. Some will offer better coverage than others, so it’s essential to do your research before settling on a plan. Additionally, even if your insurance company does cover FTM top surgery, there may be some out-of-pocket costs associated with the procedure. Be sure to ask about any potential fees before moving forward with surgery.

Insurance coverage for FTM top surgery is increasing as transgender rights become more widely accepted. However, there is still some work to get all insurers on board. In the meantime, be sure to do your homework and understand exactly what your policy covers before scheduling any surgeries.