The credit repair industry has exploded in recent years as more and more people have realized the importance of having a good credit score. But unfortunately, while many reputable companies can help you fix your credit, many scams prey on people desperate to improve their financial situation.

If you’re considering starting a credit repair business, it’s important to research and ensure you understand the industry before getting started. There are a few key things you need to know before starting a credit repair business, including:

- There is a lot of competition in the industry, so you need to be able to stand out from the crowd.

- It would be best if you were very organized and detail-oriented, as repairing someone’s credit is a delicate process.

- You also need to be able to communicate effectively, as you’ll be working with people who are in a vulnerable situation.

- Finally, you must know the law regarding credit repair and debt collection.

What Is A Credit Repair Business?

A credit repair business is a service that helps people improve their credit scores. It can be done by disputing errors on credit reports, negotiating with creditors to remove negative items, and assisting people in developing a budget and plan to improve their overall credit health.

Credit repair businesses can be started with little capital, and many resources are available to help get started. The key to success is building a reputation for being honest and practical. Then, credit repair businesses can be profitable and provide a valuable service to their clients.

Why Credit Repair Is Important?

Credit repair is important for several reasons. First and foremost importance is that it can help improve your credit score.

Second, it can help you get approved for loans and lines of credit.

Third, it can help you avoid high-interest rates. Fourth, it can help you keep your good credit standing.

Finally, it can help you improve your financial situation overall.

You can do many things to improve your credit score, but one of the most important is to make sure that you keep up with your payments. If you have missed payments in the past, make sure to catch up on them as soon as possible.

Additionally, try to keep your balances low and use different types of credit responsibly to give yourself the best chance at success.

Steps To Starting A Credit Repair Business

So, if you are wondering How To Start A Credit Repair Business, you are not alone. So many people have this very common question, so I wanted to provide you with this guide.

I am sharing the necessary steps to start a credit repair business for a beginner. So it will be easier for you to get started on the right foot and set yourself up for success in the future.

Here are the Steps to start a credit repair business:

1. Decide Your Business Model

The first thing that you need to do is decide which credit repair business model you want to go with.

Several models are available, but the two most common are the direct mail or online lead generation model and the on-site personal service model.

However, you may also decide to go with a hybrid model. You should know that each of these models has its pros and cons. For example, when you choose the direct mail or online lead generation model, you will deal with hundreds of customers simultaneously.

2. Choose Your Target Market

There are a few key things to consider when choosing your target market for your credit repair business.

First, you need to consider who would need your services. These might be people with bad credit, people trying to improve their credit score, or working on getting out of debt. Then, you can narrow your target market even further by considering age, income, location, and more.

Once you have a good idea of your target market, you need to start reaching out to them. There are a few ways to do this, including advertising, social media, and email marketing. You can also try attending events where your target market is likely to participate, such as trade shows or conferences.

3. Develop A Marketing Plan

As the credit repair industry continues to grow, it’s important for those looking to start a credit repair business to develop a marketing plan.

There are several ways to market a credit repair business. Traditional methods such as print ads, radio and TV commercials, and direct mail can be effective. However, with most people now using the internet to find businesses, it’s also important to have an online presence. This can be in the form of a website, social media pages, or even online ads.

Developing a marketing plan doesn’t need to be complicated or expensive. The most important thing is to identify your target market and determine which marketing methods will most effectively reach them.

4. Set Up Your Website Or Blog

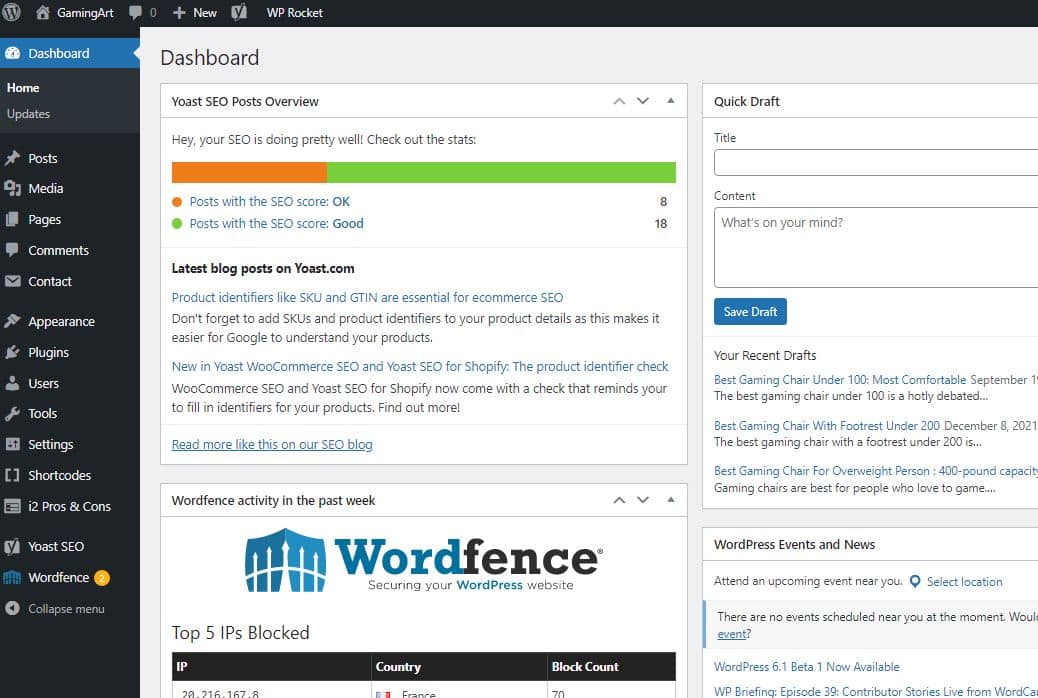

If you’re starting a credit repair business, one of the first things you’ll need to do is set up a website or blog. This will be your online home base, where potential clients can learn more about your services and contact you to get started.

Creating a professional website or blog doesn’t have to be complicated or expensive. You can use a simple platform like WordPress to get started quickly and easily. Just choose a theme, add your content and start promoting your credit repair business online!

Once your website or blog is up and running, include clear calls to action on every page. Make it easy for visitors to find your contact information and book a consultation with you. With a little effort, you can soon start attracting new clients from all over the internet!

5. Get Started On Repairing Your Own Credit First

When considering starting a credit repair business, you must consider your credit situation. After all, you can’t help others improve their credit if your credit needs some work. So before starting your business, focus on repairing your credit first.

There are a few things you can do to start repairing your credit.

First, check your credit report for any errors or inaccuracies. If you find anything that needs to be corrected, dispute it with the credit bureau. You can also start paying down any outstanding debts you may have. And finally, ensure you keep up with all your future payments so you don’t get back into the same situation again.

6. Join A Credit Repair Organization

There are many credit repair organizations out there that can help you start your own credit repair business. These organizations will help you set up your business and market your business.

Joining a credit repair organization is a great way to start the credit repair industry. These organizations can provide you with the resources and support you need to be successful. If you’re serious about starting a credit repair business, joining a credit repair organization is smart. However, it is important to make sure you choose a reputable credit repair organization. Many of these organizations are out there to take advantage of consumers. Therefore, you need to do your homework before joining these organizations.

7. Work With A Lawyer To Understand The Law

A few things you should do before starting a credit repair business to ensure you comply with the law. The first is to consult with a lawyer specializing in this area to understand the legalities involved fully. This is important because the credit repair industry is heavily regulated, and strict laws govern how these businesses can operate.

Next, you will need to obtain a surety bond. This type of insurance protects consumers from fraudulent or unscrupulous credit repair companies. The bond amount will vary depending on your state, but it typically ranges from $5,000 to $25,000.

Finally, you must register your business with the appropriate state agency. In most states, this is the Attorney General or Secretary of State’s office.

The Benefits Of Starting A Credit Repair Business

Credit repair businesses offer a much-needed service to consumers who have been victims of errors, identity theft, or simply bad luck regarding their credit scores. There are many benefits to starting a credit repair business, including the following:

- You can help people improve their credit scores and get out of debt. This can give people more financial freedom and better financial decisions.

- You can make a good income by helping people improve their credit scores. Most people with bad credit scores are paying high-interest rates for their loans, and you can help them lower their rates.

- You can make a decent amount of money by helping people improve their credit scores. You can charge a person between $50 to $200 to repair their credit score. This is not a lot of money, so it is easy to make a good living by offering this service.

- You can help people get out of debt by improving their credit scores.

- You can help people find new and better employment opportunities by improving their credit scores.

- You can start your own business from home and make a decent amount of money by helping people with their finances.

- You can become a millionaire by helping people improve their credit scores.

- You can make a good living by charging people for your services.

- You can increase your income by using the internet to market your services.

- You have a chance to start your own business and market it on the internet to help people improve their credit scores.

- You can help people improve their credit scores and make a good living by charging them for your services.

- You can start your own business and market it on the internet to help people improve their credit scores.

The Costs Of Starting A Credit Repair Business

There are a few costs associated with starting a credit repair business. First, you’ll need to purchase software to help run your business. This can cost anywhere from $100-$500.

You’ll also need to pay for a business license and insurance, ranging from $50 to $200 per month.

Moreover, you’ll need to obtain the proper licenses and bonding, which can cost a few hundred dollars. You’ll also need to have some money set aside to cover any legal fees that may come up.

You should spend at least $1,000 to maintain your credit repair business.

The Risks Of Starting A Credit Repair Business

There are many risks associated with starting a credit repair business. The most common risk is the potential for fraud. There are also risks associated with using credit repair software and the potential for errors in the repair process.

In addition, there is the potential for negative publicity if a credit repair business is not run correctly. However, if you conduct your business with integrity, avoid the potential for fraud, and follow the rules, these risks can be minimized.

What Are The Key Components Of A Successful Credit Repair Business?

There are a few key components that are necessary for a credit repair business to be successful.

It is important to understand the Fair Credit Reporting Act (FCRA) and how it affects the credit reporting process. This act governs how credit reporting agencies collect and report information about consumers and how consumers dispute inaccurate information on their credit reports.

A strong team is also important to help with the credit repair process. This team should include individuals with experience in financial management, credit counseling, and dispute resolution.

Effective marketing is essential to attract potential customers and grow the business. A company must be able to showcase its successes and build trust with potential clients.

It is important to have a plan for the future. Therefore, it is essential to take a strategic approach and develop a business plan that clearly outlines how the company will operate, what products or services it will offer, who its target market will be, and how it will compete in the marketplace.

It is important to establish good working relationships with vendors and suppliers, who will provide important financial assistance and products or services.

Companies must have the ability to attract and retain qualified employees. This includes developing a competitive compensation package, training employees and management, and promoting from within whenever possible.

Finally, the company must have a good working relationship with its customers. This can be accomplished by providing quality products and services, maintaining good communication lines with customers, and offering competitive prices.